Recently, Prosus shareholders announced that they had approved a deal with their parent company, Naspers, to effectively change the group’s financial structure. The hope is that the new structure will reduce the large historical discount that Naspers and Prosus trade at relative to the value of their underlying assets.

The deal is complex and involves a lot of moving parts. However, in this article we look at the various components of the transaction with the goal of determining if the current deal will result in the best outcomes for shareholders. As a result of the deal, Naspers shareholders will have the option to swap their shares for Prosus shares. By making the swap, shareholders will aim to benefit from a narrower discount, increased market liquidity and a greater presence in developed markets.

Naspers is a South African listed holding company with interests in online retail, publishing and various other venture capital investments. The company was founded in 1915 and throughout the 20th century was one of the largest publishing companies in South Africa. Since the 20th century, the company has continued to grow and it is currently the largest listed share in Africa by market capitalisation[1].

Naspers’ rise to dominance in Africa’s listed equity market over the past 20 years has largely been driven by its investment in Tencent. Tencent is a multinational Chinese technology conglomerate. The company was founded in 1998, and its subsidiaries market various internet related services and products. One of the company’s most lucrative assets is WeChat, a Chinese messaging, social media and mobile payments app.

In 2001, Naspers purchased 46.5% of Tencent as an early-stage investor, and since then Tencent has grown into one of the largest companies in the world, making Naspers the largest listed company on the JSE by a substantial margin.

A discounted history There is no doubting that Naspers’ investment in Tencent was one of the smartest investment decisions that the company has ever made. Over time, Tencent has grown into one of the largest companies in the world competing with the likes of Amazon, Facebook and Google and Naspers has been perfectly placed to reap the rewards.

However, for several reasons, Naspers’ shares trade at a substantial discount to the value of its underlying investments, including Tencent, and have done so for some time. The discount at which Naspers trades relative to its underlying assets is known colloquially as “the Naspers discount”. In fact, it has become such an entrenched feature of the stock that a large part of the company’s management’s time has been spent trying to alleviate the discount.

One of the boldest actions that the company has taken is listing a separate entity in Amsterdam (Prosus) that holds its internet assets, including Tencent, to try and narrow the discount (we will discuss this later). However, the action has been largely ineffective thus far and Prosus also trades at a discount to its underlying investments.

Before we get into the full list of corporate actions that Naspers management have undertaken to try and alleviate the discount, we need to understand why it exists in the first place.

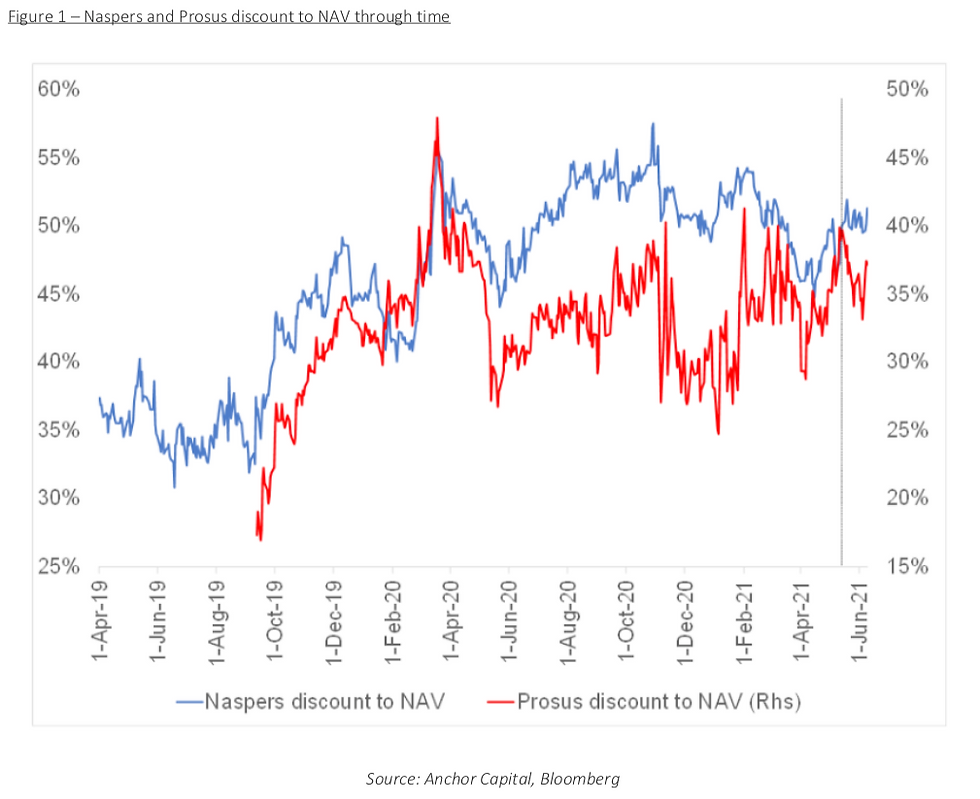

Valuing the discount Figure 1 shows the level of the Naspers and Prosus discount through time. It is important to note that the discount being measured is a discount relative to net asset value, where the net asset value (NAV) is the estimated underlying market value of all of Naspers assets less the value of the company’s liabilities. In practical terms, when a company trades at a discount to its NAV, this means that if investors were to hold individual positions in each of the company’s underlying assets, they would be worth more than holding shares in the company that owns those assets.

From the above chart, there are several factors worth noting. Firstly, both Naspers and Prosus currently trade at discounts to their NAVs, and this is driven predominantly by Prosus’ direct stake in Tencent and Naspers indirect stake in Tencent through Prosus. In addition, Figure 1 also takes into account all of the other assets that the two companies have invested in (known as the rump assets) which are also undervalued.

However, what has perplexed the market is both the persistence and extent of the discount that Naspers and Prosus trade at relative to their NAVs.

What are the reasons for the discount? Calculating the discounts of Naspers and Prosus relative to their NAVs requires accurately estimating what the NAVs of these two companies are. While some of their underlying investments like Multi-Choice Group (MCG) and Tencent are listed and it is relatively easy to determine what the value of these investments are on any given day from their share prices, many of the companies’ investments are not actively traded and valuing them becomes a more subjective exercise. However, the market generally agrees that the following factors all contribute to the current discount.

The conglomerate discount - Naspers is a conglomerate[2] that is made up of investments in a number of different entities (as seen in Figure 1 above). Generally, conglomerates trade at a discount to the sum of their parts which is driven by holding company costs and possible overestimation of management’s ability to add value for shareholders.

Different share classes - Naspers has different share classes in issuance – namely “A” shares and “N” shares, the “A” shares (held by management) have more voting rights than the “N” shares (held by outside investors – i.e. asset managers and their clients as well as direct investors). Dual share structures are not uncommon in South Africa, but they don’t often afford management such high levels of voting power, which is the case with Naspers. This means that ordinary shareholders may struggle to hold Naspers management accountable for their actions because their shares carry less voting power.

The rump assets - Tencent is only one of the investments that Naspers has made and the company’s portfolio outside of its holding in the Chinese internet giant is extensive. However, it has taken longer than expected for these investments to generate sustainable cash flows, casting doubt over management’s ability to add value outside of Tencent.

The Variable Interest Entity (VIE) - Naspers’ investment in Tencent was originally set up through a VIE that gives Naspers the right to accrue dividends from Tencent but not full shareholder rights. The reason for this is complex and has to do with large technology companies in China being deemed strategic assets, meaning they cannot be fully owned by foreigners. This is an unusual shareholding structure and not ideal for Naspers.

Tax considerations - While many of Naspers investments may be valued at attractive levels (including Tencent), to generate cash from these investments they would essentially need to be sold. This would likely trigger a capital gains tax (CGT) event. According to Perpetua Investment Management, this CGT tax rate would be at least 15%.

The size of Naspers on the JSE - One of the main reasons touted for the discount being so large has to do with the size of Naspers on the JSE. The company has grown considerably since listing on the JSE in 1994, largely due to its investment in Tencent. In fact, the size of Naspers on the JSE has become such an issue that even if local asset managers wanted to hold more Naspers, they would be unable to do so because of regulatory and risk limits.

Bearing all of this in mind, it is interesting to assess what actions management has taken historically to reduce the discount. And why they haven’t been successful.

Narrowing the discount Over the past few years, Naspers management have taken four core actions to try and narrow the discount, with the most recent being the deal with Prosus that we will assess in this article. However, to understand why the current deal came to fruition, we need to understand the previous three actions the company has taken to narrow the discount.

The New Deal The current deal that was proposed and has subsequently been approved by shareholders is quite complex and involves a number of moving parts. However, it is important to keep in mind that the goal of the deal is to narrow both the Naspers discount and the Prosus discount. In addition, the new deal will give Naspers shareholders the option to swap their shares for Prosus shares.

Under the new deal, Prosus will acquire 45% of the ordinary share capital of Naspers in exchange for newly issued Prosus ordinary shares. This would increase Prosus’ overall interest in Naspers to 49.5%.

As a result of the transaction, the free float of Prosus is expected to more than double, and the group believes this will increase the value of Prosus. Free float or percentage free float is a financial measure that represents the percentage of shares of a listed company that can be freely traded.

Historically, only about 27% of Prosus shares were available to freely traded in the market and following the deal this is expected to increase to about 43%.

The Debate and conclusion Below, we provide a summary of what Naspers shareholders should consider when deciding whether or not to swap their shares for Prosus shares.

PROS:

Narrower discount - Prosus trades at a narrower discount to NAV than Naspers does and there is potential for that discount to narrow further.

Global investor base - Prosus is listed on Euronext Amsterdam and is easily accessible by global investors. Ultimately, the stock is likely to garner greater interest than Naspers which will hopefully improve market liquidity.

Higher free float - Prosus free float will increase as a result of the transaction. Which will likely create more market liquidity and provide more potential for the discount to narrow further.

Tencent exposure - By not converting their shares, Naspers investors will dilute their exposure to Tencent, because Naspers shareholding in Prosus is set to decrease.

CONS:

Tax consequences - Naspers shareholders are likely to trigger a capital gains tax event when they swap their shares for Prosus shares.

Deal complexity - The deal is made complex by the cross shareholding, and there may be unintended consequences as a result.

Rump asset exposure - By converting their shares into Prosus shares, Naspers shareholders dilute their exposure to Naspers rump assets.

Management control - In both Prosus and Naspers, management control remains a concern for investors through their holding of “A” shares and this will not change if investors participate in the swap.

No narrower discount - even if investors do partake in the share swap, there is no guarantee that the Prosus discount will narrow.

Setting aside the complexities of the deal, Prosus shareholders are likely to gain more from the transaction than Naspers shareholders. The free float of the company is likely to increase and with that, the stock will likely become more liquid allowing more investors to buy it. On the other hand, the free float of Naspers is likely to decrease considerably and, in the process, Naspers ownership in Prosus will also decrease, giving investors less access to returns generated from Tencent.

Some South African asset managers also feel that because the deal seems more favourable to Prosus shareholders than it does to Naspers shareholders, in the future, Naspers management’s interests may be more aligned with Prosus shareholders. This is an important point because Naspers management hold “A” shares in the company which grant them more voting power than “N” shareholders.

In addition, it is not certain that the current deal will be successful in addressing the discount and we could see further changes to the group structure intended to unlock value for shareholders. Our view is that complex structures are often used in the market to financially engineer better outcomes for investors. And at times they do work, but often produce unintended consequences.

However, not all investors feel that the deal is unfair and will be ineffective. Clearly, one of the intended purposes of the deal is to increase the presence of Prosus in developed markets. With the stock being listed in Europe and becoming more liquid in the process, it becomes a better option for developed market investors than the locally-listed Naspers.

Another important take away from the transaction is that around R700bn in value will essentially be shifted from Naspers to Prosus as part of the share swap. While this may be seen as an externalization of wealth, we don’t feel that this is the intended consequence of the deal, with the focus being placed more on setting Prosus up as the group’s preferred listed investment vehicle and allowing room for growth outside of Tencent.

Ultimately, it is difficult to say at this point whether the current deal will be successful in addressing the discount that both Naspers and Prosus trade at relative to their respective NAVs. However, it is difficult to argue with the logic set forward by the Naspers management team as to why the deal will be successful. With that in mind, Naspers shareholders will likely be better off converting their shares into Prosus shares and benefitting from enhanced liquidity and presence in developed markets.

[1] The total rand value of a company’s outstanding shares of stock. [2] A company that consists of multiple different companies that operate in different industries.

Comments